By Nitesh Jindal, Dr Ram Manohar Lohia National Law University, Lucknow.

Goods and Services Tax (GST) is an indirect tax which will bring transparency and effective governance in the country. It is a destination-based tax levied at multiple stages, starting with the manufacturing stage, to the sale of goods stage, whose overall burden has to be borne by the final consumer. GST has paved the way for a common national market by subsuming many indirect taxes, which, previously, were being levied by the Centre and the States, at various stages of production and which in turn had created many complications, such as, overburdening the consumers by various taxes, cascading of taxes, etc.

Implementation of GST has reduced the overall tax burden on the consumers and has made the products more consumer-friendly. Promising to reduce the cascading effect of taxes or double taxation, GST so far has proved itself to be up to the mark to the expectations of the people, and despite its technical glitches, people from all across the country have supported this new indirect tax regime.

One of the primary objectives of the Goods and Services Tax is to harmonize the relations between the Centre and the States. Hence, by the 122nd constitutional amendment, such an attempt has been made. Previously there was a clear cut demarcation of fiscal powers, wherein, the Centre used to levy taxes on the manufacturing of goods while States were supposed to impose taxes on the sale of goods, but in the present tax regime, there is a concept of dual GST which is being followed. According to the same, taxes will be levied and collected by the Centre and the States separately per se, but a concurrent levy system will be followed on the supply of goods. This amendment has given impetus to the much needed concept of cooperative federalism.

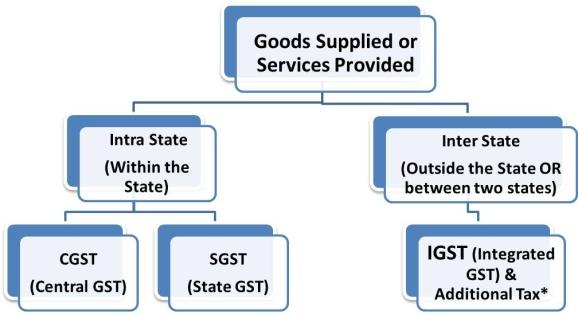

Dual GST Model: The Government has decided to follow the dual GST model, wherein both the Centre (Central Goods and Services Tax) and the States (State Goods and Services Tax) will receive taxes separately but concurrently. Apart from CGST & SGST, the Centre, in order to avoid confusion amongst the States, has kept the exclusive power to levy IGST (Integrated Goods and Services Tax) on inter-State trade of goods and services. SGST is levied on Union Territories with a functioning legislature, while UTGST (Union Territories GST) is levied on Union Territories without a legislature in place. Thus, transactions within a State attract the CGST and SGST, while an inter-State transaction attracts only the IGST.

GSTN: Goods and Services Tax Network is a private, non-profit and non-governmental organisation, which provides three front end services, namely registration, payment to taxpayers and return to the taxpayers. It is trying to setup a robust and efficient IT backbone for the States, for smooth functioning of the GST.

GSTC: As per the recently added Article 279A of the Constitution, the Goods and Services Tax Council comprises of the Union Finance Minister, Union Minister of States and Minister-in-Charge of Finance from each State, who will make recommendations from time to time, regarding the important issues related to the GST and the principles that will govern GST.

Concept of GST: How is it different from the old regime?

It is pertinent to understand how this new tax regime is better than the old regime. For this, we have to first de-code the lacunae in the old regime. Before the introduction of Value Added Tax (VAT), tax on tax or cascading of taxes was apparent, however, VAT was not being imposed on actual sales. But, VAT included Excise Duty as an important component, which was levied by the Centre, hence ensuring that the tax on tax model was not really done away with. The government seemed reluctant to implement the “one nation, one tax” model. With the introduction of dual GST, this lacuna has been done away with.

For e.g., Mr X sells some goods worth Rs. 100 with sales tax at 10% to Mr Y. Then Mr Y resells the goods for Rs. 110 with sales tax at 10% to Mr Z. The trouble with this entire transaction is, that Y while determining his tax liability, included sales tax on the previous purchase. This is therefore, an example of tax on tax. With the introduction of VAT in 2005, Mr Y had to pay just Re 1 to the government, as he had already paid Rs 10 as tax to Mr X during his previous purchase. With this measure, the problem of cascading of taxes was to a great extent resolved, however, it still remained intricately present in the system.

Credit of input VAT was adjustable with the output VAT. Credit of input excise/service tax was adjustable with the output excise/service tax. But credit of the output VAT could not be available against excise, and VAT was computed, with the inclusion of. There was an increase in the price of goods and services, thus creating an unnecessary burden on the consumers. n order to get rid of this impediment, the government was enthusiastic about enforcing GST in the Country. GST will subsume various taxes levied by the centre like Central Excise Duty, Service tax, etc., and State like State VAT, Central Sales Tax, Luxury Tax, etc. GST has subsumed various indirect taxes, like Central Excise Duty, Service Tax, Luxury Tax, etc., into one tax.

Benefits of GST

For the Consumers: Consumers have benefited because of the lower taxes imposed on necessary items. The consumers have, in turn, becomes more business and tax friendly.

For the Business(es): Tax compliance is much easier post-GST, thanks to the digital character associated with it. Inter-State movement of goods is smoother than before. A leap in the Ease of Doing Business Ranking, from 130th position last year, to 100th position this year, speaks a lot about the far-reaching implications of the GST on the business sector.

For the Government: Tax evasion, to a large extent, has come to a halt, owing to a change in the attitude of people and largely due to the digital trail of business and tax. Higher tax revenue has provided the necessary confidence to the government, to roll out various developmental programmes for the poor, for e.g., the National Health Protection Scheme, Eklavya Schools, Operation Green, etc., which is evident from the Budget 2018. GST, on the whole, by securing a unified national marketplace, has bolstered the Make in India Programme, and has thus been able to generate more employment in the Country.

Conclusion

One nation, one tax has had very wide positive implications and outcomes. And by getting rid of the old system, India has entered into a new era- an era of transparency, efficiency and accountability. Getting rid of the cascading effect of taxes seems to be one of the major driving forces, for the implementation of the GST. Since GST has rolled in, multiplicity of taxes has been done way. Above all, digitization of the trail of tax and business has enabled the citizens to pay taxes regularly (read easily), due to less compliance cost and has resulted in a reduction in the number of tax evasions. All the important players in the society, i.e., consumers, businesses and the Government are gaining advantage under the GST regime, at optimum levels.

GLOSSARY:

Cascading effect of taxes: A tax that is levied on a good at each stage of the production process up to the point of being sold to the final consumer.

Value Added Tax (VAT): A tax on the amount by which the value of an article has been increased at each stage of its production or distribution.

Compliance Cost: This is an expenditure of time or money in conforming with government requirements such as legislation or regulation.

Central Sales Tax: A levy of tax on sales, which are effected in the course of inter-State trade or commerce.

Luxury Tax: A tax placed on products or services that are deemed to be unnecessary or non-essential. This type of tax is an indirect tax in that the tax increases the price of the good or service and is only incurred by those who purchase or use the product.