On 5th February 2020 the Finance Minister introduced “The Direct Tax Vivad se Vishwas Bill, 2020” in the Lok Sabha. The primary objective of this Bill was to provide a solution for income tax disputes which are pending. Thereafter, some official amendments were proposed by the key stakeholders. After the amended Bill was passed by the Lok Sabha and the Rajya Sabha, it finally received the President’s assent on 17th March 2020 and thus the Direct Tax Vivad se Vishwas Act, 2020 came into being.

Addressing Tax Disputes

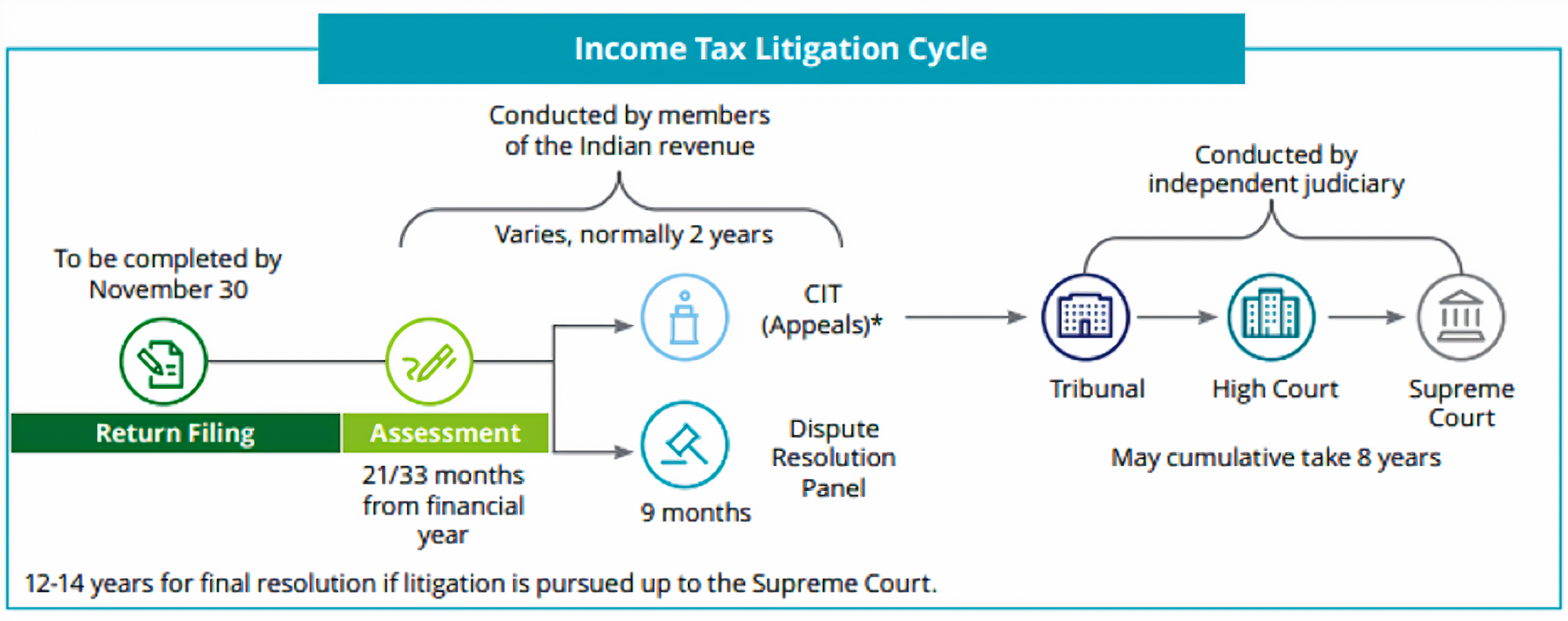

Income tax is the primary source of revenue of the government and helps bridge the gap between rich and poor sections of the society. Over the years, the number of taxpayers in India has increased and so have the tax litigation cases. Due to poor litigation management by IT Department and multiple forums for appeal like the Commissioner of Income Tax, Income Tax Appellate Tribunal, High Courts and the Supreme Court in cases involving question of law; the number appeals at all these fora has risen to 483,000 as on 30th November 2019 with 9.32 lakh crores disputed tax arrears.

Image Source: Reducing Income tax disputes in India: A way forward, Deloitte

It’s interesting that 85 percent of these appeals are filed by the Income Tax department itself, thereby wasting time and resources for the regulators as well as the taxpayers. The main reason for this is the fact that revenue authorities prefer to go for an appeal without going into the merits of the case. This is also why the department only has about 30-35 percent cases adjudged in its favour in these appeals.

It was thus deemed necessary by the government to reduce the number of litigation cases to save time and resources as well as for liquidation of the revenue stuck in these disputes. The new Act is thus an outcome of this necessity.

Provisions at a Glance

The 2020 Act provides the Vivad Se Vishwas scheme for building confidence among the taxpayers and to encourage them to settle their disputes by paying part of the disputed tax arrears. It provides relief to the taxpayers in the form of partial or total waiver of the interest or penalty on the disputed tax if the total amount calculated by the authority is paid by the taxpayer before 31st March 2020 and the appeal was pending as on 31st January before the Commissioner (appeals), Income Tax Appellate Tribunals (ITATs), High Courts or the Supreme Court.

To avail this scheme the taxpayer has to file a declaration before the appointed authority in the specified form. Thereafter the amount to be paid by the taxpayer has to be determined by the appointed authority within 15 days from the date of receiving the declaration and undertaking from the taxpayer, after which a conclusive order will be passed by the said authority. The government has high hopes from this Act but this is not the first such attempt to settle income tax litigation disputes and appeals. In 1998, the government came up with the Kar Vivad Samadhan Scheme to resolve disputes pending at various levels of appeal, however it did not lead to the necessary course correction.

Fault Lines

In recent years the Central Board of Direct Taxes (CBDT) has shifted its focus on litigation management but at the same time, the decision to reward performance credit to officers for enhancing the effectiveness of their orders, shows confusion on the part of revenue authorities. This indicates that pendency of appeals is not a new problem for the revenue authorities but the government has failed to address this problem efficiently. This is because of the focus on temporary solutions such as waiver to dispose of disputed cases rather than discouraging the tendency of revenue authorities to litigate endlessly irrespective of merits of the case. The present Act also addresses the temporary issue of recovering the revenue stuck due to pendency of several litigation cases. However, it must be noted that most of the appeals are pending before the CIT and ITAT, which means that the taxpayers still have a remedy before the High Court and Supreme Court. Such disputed cases will hence hardly be resolved through the new provisions, as the taxpayers can always choose to approach the court rather than paying off a disputed amount of tax claimed by the authorities.

The Act does not provide any flexibility or choice with regard to the issues the taxpayers would want to resolve under its provisions. It states that the appeal must be withdrawn in its entirety whereas it’s probable that if the taxpayers are confident of a favourable decision on some points of the appeal, they would not want to compromise or dispose of those points of contention. In such cases it will be very difficult for the taxpayers to determine whether they want to adhere to the provisions of the Act or not.

On agreeing to settle the dispute under the Act, the taxpayer also does not have an option to challenge the amount determined by the appointed authority. This means that even if there are chances of error in determining the final payable amount, there is no provision in the Act that allows for rectification of such errors. Moreover, the amount of tax will have to be paid as per the decision of the authorities which defies the point of the earlier dispute, with the only relief being waiver of interest and penalty. This is easier said than done, since if the taxpayers were willing to pay off the determined tax amount merely because of a waiver of the interest and penalty, there wouldn’t have been as many pending tax disputes in India as there currently are.

It is also argued that such policies can downgrade the morale of honest taxpayers. If the government will bring out provisions to facilitate tax evaders and non compliant litigants, the honest taxpayers will be discouraged to comply with the income tax deadlines and rules, which might result in an increase in non-compliance.

Recommendations for better Tax Recovery Policies

- To attract the taxpayers who still have remedy before the High Court and Supreme Court, the government can provide additional incentives to encourage payment of taxes apart from interest and penalties waiver. This was witnessed with the Sabka Vishwas Scheme for indirect taxes where the main reason for its successful implementation was the provision for 40 to 70 percent tax waiver.

- The designated authority should also take into consideration the amount of money already spent by the taxpayer in the litigation process, while calculating the payable amount. The taxpayer should also be allowed to file a rectification application in case there is an error in determining the amount payable.

- The government should strengthen the legal framework for income tax administration and should take punitive measures against the assessing officers who make arbitrary orders or prefer to appeal without looking at the merits of the case.

- The income tax policy regime should be made simple and the income tax rates should be reasonably determined, with better incentives for proper compliance with tax payments, so that individuals and organisations are encouraged to pay the income tax willingly, without the need for amnesty schemes and policies thereby reducing non compliance.

Given the fact that the income tax authorities in India have most disputes resolved against their tax assessment, it can be safely said that even if the new Act is able to successfully recover 20 percent of the tax arrears stuck in litigation, it can be considered a feat for our current tax mechanism.The tax regime in India needs better long term policies, but in the meanwhile, this Act will not only help the government in generating timely revenue but can also help the taxpayers save their time and resources.

By Dharmendra Kumar Lambha, Research Associate, Policy