By Anmol Kaur Bawa, Symbiosis Law College, Pune.

Self-Help Groups (SHGs) have pioneered the idea of microfinance investment in the Southeast Asian countries in the realm of globalisation. A Self-Help Group, as the term suggests, is a collective of borrowers at a micro-level, which takes loans from the bank under the combined representation of a group and lends among its members at a lower rate of interest. The individual earnings then, form a part of the group savings, in turn deposited to the bank.

SHGs have gradually bloomed to be women centric since the 1990s. As per surveys conducted by Andhra Pradesh Mahila Abhivruddhi Society (APMAS), a major push for this has been, the increasing economic complexities in the rural livelihood, which have enabled the women to come out of their socially determined places in the household and enter financial networking.

Timeline of SHGs’ Evolution In India

- 1987: The National Bank for Agriculture And Rural Development (NABARD) provided MYRADA (NGO, Bengaluru) with a grant of ₹1 million to enable it to invest resources in identifying affinity groups, building their capacities and matching their savings after a period of 3-6 months.

- 1990: RBI accepted the SHG strategy as an alternative credit model.

- 1992: NABARD issued guidelines to provide the framework for a strategy that would allow banks to lend directly to SHGs.

- 1992: SHG-Bank Linkage Programme was launched.

- The Tamil Nadu Women’s Empowerment Project, an International Fund for Agricultural Development (IFAD) supported project implemented through the Tamil Nadu Women’s Development Corporation, was the first project in the country, around 1990, to incorporate the SHG concept into a state-sponsored programme. Since then, SHGs have been associated with women.

SHG-Bank Linkage: Factors Enabling Women’s Participation

The key aspect in the SHG-Bank linkage scheme is the wide ambit of independence granted to women’s groups. The guidelines under the scheme provide for only the skeleton of the working of a Self-Help Group, while the members of the group are the ones to fill in the flesh and blood, to determine the details and a set the objectives as to what the SHG aims for.

Firstly, the NABARD guidelines on SHG provides for basic essentials to form a “self-help” group which include the following:

(i) The ideal size of an SHG is 10 to 20 members. (In a bigger group, members cannot actively participate.)

(ii) The group need not be registered (this provides room for flexibility to those women unaware or unable to go through the rigorous registration process)

(iii) From one family, only one member is allowed. (More families can join SHGs this way.)

(iv) Members have the same social and financial background (Members interact more freely this way.)

(v) The group should meet regularly. (Members understand each other better if they meet weekly.)

(vi) Compulsory attendance. (Full attendance for larger participation.).

These essentials work as preliminary steps for strengthening assurance and organisation among women groups.

Secondly, RBI/NABARD rules stipulate that no collateral security should be taken from SHGs by public and private banks. The reason for not making Collateral security mandatory for the loans sanctioned to SHGs is that it exerts moral pressure on the borrowing members for repayment, which in turn ensures, that banks get a better chance of repayment from the SHGs. Furthermore, the low rate of interest, that is two-three rupees per hundred rupees per month gives further impetus to women to work on a practical investment.

Thirdly, the increased involvement of NGOs as promotion agency for SHGs, since 2000, especially in the Southern and Peninsular states of the country have led to a massive push for rural SHG establishments. The researcher at this point shall construe this a sensitizing role played by the NGOs in bringing women together. The women rights specific NGOs, in states such as Tamil Nadu, work on psycho-socio areas where much of the reformation is needed to convince people of the idea of women-centric self-lending associations.

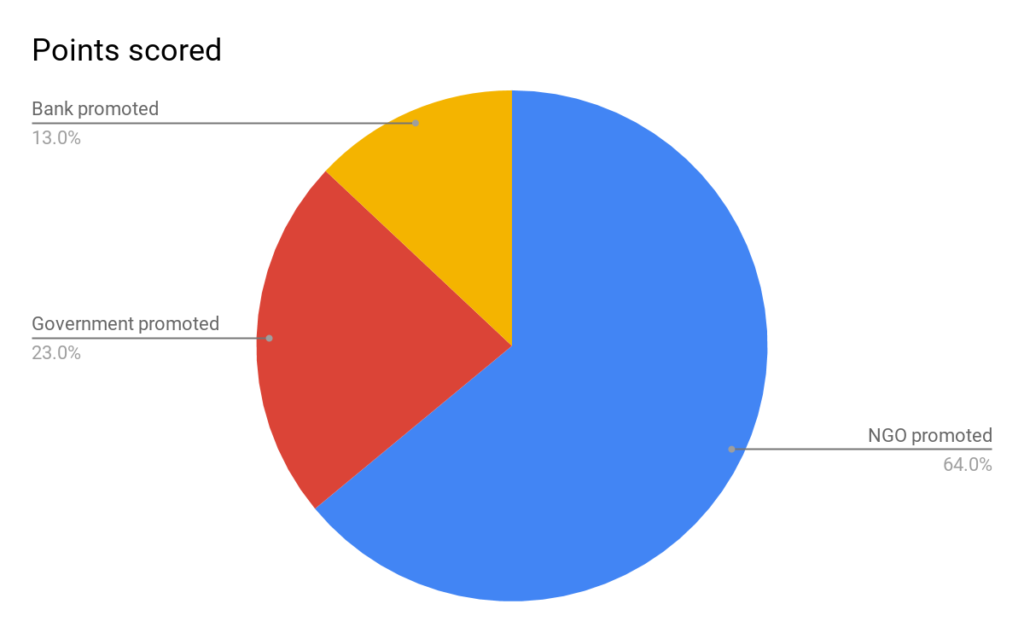

The following is the empirical evidence on the key involvement of NGOs in establishing SHGs, as per a study conducted by APMAS in 2000. Amongst 214 SHGs spread across four states, namely Andhra Pradesh, Rajasthan, Karnataka and Orissa, the following is the percentage of influence garnered by the three main Self-Help Promotion Agencies (SHPA), NGOs, Government agencies and Banks.

Dropouts: The Internal Turmoil

A major reason for discontinuity of SHGs is the unfortunate dropout of women due to several issues hovering over their personal and private lives. In the sample study conducted by APMAS, about 9.8% of dropout incidences have been reported. The common observation in most states is that the general reasons for such dropouts include:

Physical factors- Migration, Death, Illness;

Financial factors- Inability to save, Inability to make regular repayments;

Internal factors- Disagreement with group norms, Intra-group conflict, Dual membership;

Social factors- Interference by husbands, Family pressure, Prior engagement in house chores.

However, the burning question at this point is, have the NABARD guidelines under the SHG-Bank linkage scheme provided for any resolution to such crisis in terms of an alternate approach or relocation to a new SHG on migration, or the right to the heir of the deceased to continue the latter’s role in the group? Or should the NABARD limit itself to only financial assistance despite being a welfare organ? Perhaps, even if it widens its ambit of assistance, where shall the aggrieved parties approach? The rural policy of RBI and NABARD remains silent on these issues.

Is There Room For Transparency?

The most feared notion among women-led SHGs is containment of trust with banking institutions. The researcher would bring to notice the previously mentioned pie-chart, wherein the lowest fraction of initiative is represented by banks (13%). The reason for this, as stipulated, is the reluctance on part of the banks to let out loans on low rates of interest. The job is, in researcher’s opinion that of a ‘welfare’ character and banks certainly don’t have a knack for such “alien” terms.

Perhaps, what is essential for the continuation of SHGs is their healthy rapport with the bank and transparent transactions especially on part of the bank administration. To regulate efficient banking, NABARD’s legal department had launched the Banking Ombudsman Scheme 2006. The Ombudsman therein, is in charge of the complaints filed by borrowers, for all kinds of banking institutions, including the Regional Rural Banks and the functions performed by them. The Zonal Officers appointed by the Ombudsman have the authority of registering grievances and awarding compensation through mediation and conciliation under alternate dispute resolution method. However, the Scheme isn’t without its fallouts.

As per the Scheme, the Ombudsman works independent of any rules of evidence. Here the risk of arbitrary investigation increases. Moreover, the Scheme fails to take into account the fact that most women in rural areas are illiterate, which renders them unable in filing written complaints. Another issue here, is lack of knowledge about this Scheme in remote villages of the country. In this regard, it is also relevant to talk about the constant objections raised by the All India Democratic Women’s Association about the issue of biased decisions of various mediation and conciliation sessions. Reportedly, the counselling done at such sessions through the ADR mechanism, often pressurises women to compromise on their part, moulding them back to the predetermined social constructs.

In a nutshell, any discussion of Self Help Groups cannot be had in the absence of gender sensitivity. Gender sensitized schemes and gender neutral arbitration mechanism is what the NGOs and NABARD should aspire for and in turn strengthen their reach out as the agents of social change and women empowerment.

References:

- Ishita Akhoon, How Women In India Are Able To Help Each Other Through Self-Help Groups, YKA, May 24,2017.

- NATIONAL BANK FOR AGRICULTURAL AND RURAL DEVELOPMENT (NABARD), A Handbook On Forming Self-Help Groups (1994,2nd edition).

- Kim Wilson The Fletcher School, Self Help Groups in India – A study of the lights and shades, Tufts University Formerly, Catholic Relief Services, South Asia.