By Siddhant Sharma, Amity Law School, Jaipur.

India being a developing country and one of the biggest economies, has seen an increasing participation of multinational group in economic activities which has resulted in a substantial increase in issues related to transactions entered between two or more enterprises belonging to the same group. This is when the need for transfer pricing regulations emerged in India. The case of Vodafone Essar which related to the transfer pricing regime was a very significant judgement by the Supreme Court. Vodafone acquired Hutchison Essar which was the fourth largest mobile phone operator in India by paying $ 10.9 billion in May, 2007. The tax authorities in India sought $ 2.1 billion from Vodafone as a result of Vodafone making that purchase of Hutchison Essar shares. The tax authorities in India argued that Vodafone should have withheld the $ 2.1 billion and paid the $ 2.1 billion to India. The Indian Supreme Court held in favour of Vodafone on January 20, 2012. On the other hand, Indian Advance Pricing Agreement (APA) might not be the most attractive APA regime in terms of the heavy fees the multinationals need to pay at the time of filing application considering the fact that country like Japan and Australia do not charge any filing fees that too being the first countries to implement them. The fees ranging from rupees 10 lakh to 20 lakh can be termed as very high considering the amount of international transactions that are proposed to be undertaken. Thus the paper will focus on the issues pertaining to the impact of APA in India and also its significance in the international market per se.

Explaining APA’s–

‘Tax complexity itself is a kind of tax’, as is said by Max Baucus[i]. . Advance pricing agreements is way to assure the taxpayers i.e. the associated enterprises that they are not exposed to possible tax risks.

An Advance Pricing Agreement is a codified agreement between the taxpayer and the taxing authority to formulate a method for the calculation of the transfer pricing methods functional in the intercompany transactions which is usually for a period of multiple years. Such is the essentiality of APA that it not only provides confidence to the taxpayer regarding their transfer pricing methods and helps them to resolve their transfer pricing disputes before they become well established it also reduces the complexity of procedures as the AE’s have just need to work in accordance to the terms as decided in their APA and they are freed from the regular checkups from the tax authorities.[ii] APA’s can vary in their type depending upon the needs of the MNC’s. It can either be a unilateral agreement between the taxpayer and the Internal Revenue Service’s or it can be multilateral or bilateral which includes agreements between the taxpayer and one or more taxing administrative authorities.[iii] APA’s also offer several other benefits companies. APA reduces the incidence of double taxation, and the costs associated with both audit defence and documentation preparation. They provide greater certainty on the transfer pricing method adopted, mitigating the possibility of disputes.[iv]

In Advance Pricing Agreement (APA), the taxpayer must give details about the pricing methodology that it intends to apply to the transactions covered by the APA and must explain why the methodology would produce an appropriate result. OECD has been working for many years to achieve an international consensus on transfer pricing rules. In 1979, the OECD published a report entitled “Transfer Pricing and Multinational Enterprises”, which advocated the adoption of arm’s length principle to determine the prices of transactions between associated enterprises. Many countries have attempted to deal with perceived transfer pricing abuses by requiring MNCs to provide the tax authorities with extensive documentation to support the methods they used to establish their prices. The idea is that by forcing MNCs to establish their transfer prices in advance, a country can prevent after-the-fact shifting of income for tax avoidance purposes.[v]

APA Framework and Rules in India–

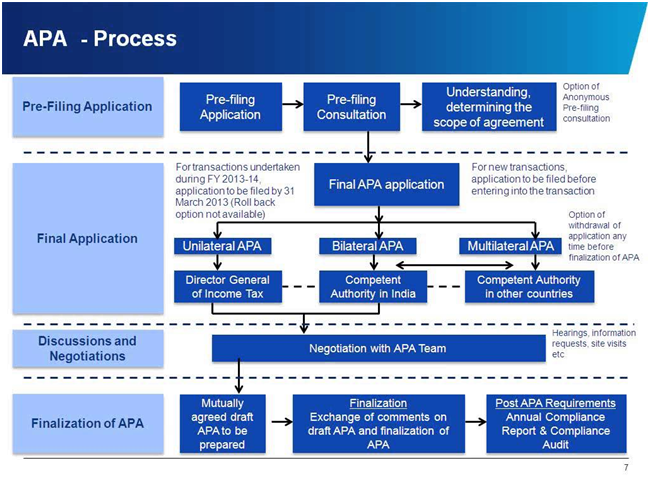

The provisions for the APA programme as introduced by the Finance Act, 2012 are mentioned in section 92CC and 92CD of the act. These sections read with Rules 10F to 10T and 44GA (added after the 10th amendment in Income Tax Rules 2012) provide the Advance Pricing Agreement Regime in the Indian transfer pricing environment[vi]. The eligibility criteria for filing an application is “that any ‘person’ undertaking an international transaction or planning to undertake any such transaction can file an application for APA as mentioned in section 92CC (1) of the act read with rule 10G of the rules.” The term for APAs in India ranges from a minimum period of three years and up to a maximum period of five years. The Indian APA scheme follows a five stage process which once concluded brings the APA agreement in effect. The stages involved in the process are-

- Pre-filing consultation

- Formal application of an APA- The filing fees for an APA are as follows[vii]:

| Values | Fees |

| Where the value of international transactions not exceeding Rs.1000 million | 1 million |

| Where the value of international transactions not exceeding Rs.2000 million | 1.5 million |

| Where the value of international transactions exceeding Rs.2000 million | 2 million |

- Analysis and evaluation

- Finalising and signing an APA and,

- Execution, monitoring and review

Conclusion–

The whole idea behind the introduction of APA in India is to determine an optimum Arm’s Length Price and reduce the lengthy litigation process in tax matters. Apart from this, Business Restructuring is another key concern. But apart from this the process of APA is complex per se. Also there are certain aspects which have not been covered in the Indian APA regime and should have been covered. These are:

- Rollback of APA– this is one concept that is absent from Indian APA scheme. This concept provides the use of methodology agreed in the APA in the years where audit for prior years are open. The feature can have significant impact in cases where the facts are similar[viii].

- Lack of Confidentiality– the tax authorities in India does not protect the taxpayer’s information from reaching public domain. Confidentiality being a critical issue the tax payers becomes vulnerable if, information related to their business predictions and revenue model is shared in public[ix].

- Transparency– Transparency is one feature that provides a sense of confidence to the taxpayer, if he gets to suggest the tax authorities about developing their procedures. This feature can also help to set the level of public expectation once the taxing authority presents its own views in the public.

Therefore, these are certain aspects which should have been considered and can still be implemented in any future amendments by the taxing authorities in order to make the Indian APA regime more effective.

[i]The Hidden Federal ‘Tax’ All Small Businesses Must Pay, by Keith Girard, http://www.allbusiness.com/economy-economic-indicators/economic-conditions-depression/15550916-1.html

[ii] See http://www.transferpricing-india.com/Advance_price_agreement_APA.htm

[iii] See http://www.caclubindia.com/articles/advance-pricing-agreement-a-step-ahead-15703.asp#.Uh9vBDZkPuQ

[iv] See http://www.pwc.com/gx/en/tax/transfer-pricing/advance-pricing-agreements.jhtml

[v] International Tax Premier by Brian J. Arnold, Michael J. McIntyre, 2002

[vi] See http://www1.grantthornton.in//html/services/tax-services/transfer-pricing/

[vii] See http://www.bmrtax.com/PDF/714Vol7%20issue%209%205.pdf

[viii]See http://www.gowlings.com/knowledgecentre/PublicationPDFs/20121015_India_Introduces_Guidelines_Advance_Pricing_Arrangement_Program_Dale_Hill.pdf

[ix] Indian Advance Pricing Agreement Regime, The Game Changer 2012, by Grant Thornton