By Nitesh Jindal, Dr Ram Manohar Lohia National Law University, Lucknow.

Atal Pension Yojana (APY) is a government backed guaranteed monthly pension scheme for all citizens, mainly for the unorganised sector, which is concerned with the income security of old age working class. Every citizen of India is eligible to avail the benefits of this scheme. This scheme, in order to address the issue of longevity in the unorganised sector, encourages mainly the unorganised class, to save for their retirement. The sole responsibility for the administration of this Scheme has been given to PFRDA (Pension Fund Regulatory and Development Authority).

Background

Workers in the unorganised sector constitute about 88% of the total labour force as per the 66th Round of National Sample Survey Organisation (NSSO) Survey of 2011-12. But there was no formal pension scheme available for them earlier, hence the Government of India in the year of 2010-11, launched the Swavalamban Scheme. The reason for substituting the Swavalamban Scheme with the Atal Pension Yojana is that the former was unable to ensure to its subscribers a guaranteed monthly pension. So, the Government of India, in the budget session of 2015-16 announced this universal social security APY scheme in the Insurance and Pension sectors, for all citizens.

Overview

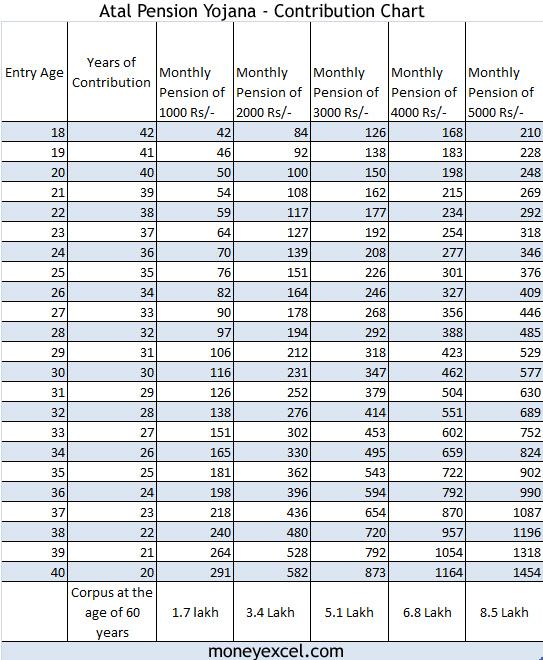

Under this scheme, the subscribers would receive a fixed pension of Rs. 1000/2000/3000/4000/5000 per month, beginning at the age of 60, depending on their contribution earlier. Minimum age for subscribing to this scheme is 18 years, while the maximum age is 40 years. It means that the contribution of any subscriber towards this scheme would be a minimum of 20 years.

Co-contribution: The Government of India (GoI) shall co-contribute 50% of the subscriber’s contribution, or Rs. 1000 per annum, whichever is lower. The government aims to contribute to each subscriber for a period of five years from the financial year 2015-16 to 2019-20, for all subscribers who joined the scheme between the period of 1st June, 2015 to 31st December, 2015. This co-contribution would not exceed five years, for all subscribers including the migrated Swavalamban beneficiaries as well. Government co-contribution would not be available for those who are already covered under any other social security scheme like Employees’ Provident Fund and Miscellaneous Provision Act, 1952; Coal Mines Provident Fund and Miscellaneous Provision Act, 1948; Seamens’ Provident Fund Act, 1966; or any other social security scheme.

Co-contribution: The Government of India (GoI) shall co-contribute 50% of the subscriber’s contribution, or Rs. 1000 per annum, whichever is lower. The government aims to contribute to each subscriber for a period of five years from the financial year 2015-16 to 2019-20, for all subscribers who joined the scheme between the period of 1st June, 2015 to 31st December, 2015. This co-contribution would not exceed five years, for all subscribers including the migrated Swavalamban beneficiaries as well. Government co-contribution would not be available for those who are already covered under any other social security scheme like Employees’ Provident Fund and Miscellaneous Provision Act, 1952; Coal Mines Provident Fund and Miscellaneous Provision Act, 1948; Seamens’ Provident Fund Act, 1966; or any other social security scheme.

Eligibility: Any citizen of India can join the APY with the age requirement being 18-40 years. Another essential is the presence of a savings account in a post office or bank. A person, who after joining the APY takes the citizenship of another country, would no longer be a subscriber to this scheme.

Penalty: The subscriber has to ensure that there is required balance in the savings account/ post office savings account on the stipulated dates to avoid any overdue interest or penalties. The monthly/quarterly/half-yearly contributions may be deposited on the first day of month/quarterly/half-yearly. And if there is a default in the payment, the contribution will have to be paid in the next month along with the due penalties. Delayed payments will vary from Re 1 per month to Rs 10/- per month.

| Monthly Contributions (Rs.) | Penalty Charged per Month (Rs.) |

| Up to 100 | 1.00 |

| Between 101 to 500 | 2.00 |

| Between 501 to 1000 | 5.00 |

| More than 1000 | 10.00 |

But if the default in payment continues for 6 months, the account will be frozen; after 12 months the account will be deactivated, and after 24 months, such accounts will be closed. The subscriber thus needs to ensure that the bank account is duly funded for ‘auto debit’ of contribution amount.

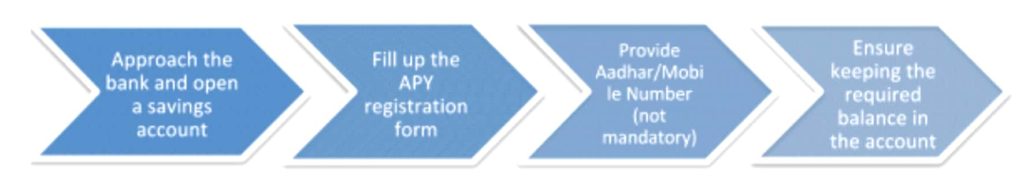

Procedure for opening an APY account:

Exit: On attaining the age of 60 years, the subscriber is free to exit from APY with 100% annuitisation of pension wealth and the pension would be available for him. However if the subscriber dies, then the pension would be available to his/her spouse and if both of them die (subscriber and spouse), the pension would be returned to his nominee. Exit before the age of 60 years is not permissible, however it is allowed in exceptional circumstances, i.e., in the event of death of the beneficiary or in case someone encounters a terminal disease.

Benefits:

1. It is a harsh reality that old people face abuse, ill-treatment, isolation, etc.; APY is a significant scheme, which will, somewhere down-the-line help the senior-citizens to live an independent life and will thus help them to know their rights and duties.

2. In India, particularly in the unorganised sector, women are housewives and they generally do not have any fixed income. Their life-span is greater than the men, which becomes a cause for gender discrimination. Such discrimination against women, I believe, will take a U-turn here on. This will not be apparent today but, we will see the changes 20 years from now.

3. The government has tried to maximise the benefits provided to the younger generation, under this scheme. This move will help ensure that they do their work with full enthusiasm and energy, and contribute to the society with the best of their abilities, due to assured protection being made available to them in their old age.

4. Assured monthly fixed pension will help the citizens to live a dignified life, especially when they are old. This scheme will help assure a decent standard of living for them.As the increasing cost of living will prove to be painful for the target group,, this pension will help alleviate their suffering to some extent.

Conclusion

APY is a scheme which will enable the citizens, to lead a dignified life, with maximum security and minimum uncertainty. The Swavalamban scheme was replaced with the APY scheme, due to the various inabilities associated with the implementation of the former, at the grassroots level. The Government can be seen as playing a proactive role here, as co-contributors, which has in turn, helped a lot of students to avail the benefits under the scheme.

Government has tried to adopt a persuasive approach with respect to this scheme, in order to get as many registrations as possible. Some of the methods that have been used are: very low penalties on default, low monthly contributions, very easy procedure for registration and exit. The standard of living of the citizens will also improve, and thereby help the new and vibrant generation to come forward and help contribute towards the flourishing economy, we wish to create.