The spread of COVID-19 has exposed the inadequacy of measures nations claimed they had, to deal with a crisis. A microorganism succeeded in locking down nations, disrupting markets, and exposing loopholes in the existing policies and welfare systems. As India wades through the stormy seas of averting a health crisis, millions are left bereft of livelihoods and safety nets. The plight of migrant workers has brought to light the true state of our social infrastructure as they were denied basic services to even get back home.

Thomas More in his 16th century book titled Utopia wrote ‘…provide everyone with some means of livelihood, so that nobody’s under the frightful necessity of becoming, first a thief, and then a corpse’. Since then, several humanist thinkers, politicians, billionaires and social activists have lent their support to Universal Basic Income (UBI). The Economic Survey of 2016-17 had designated UBI as a powerful idea to be deliberated upon but not yet ripe for implementation. As the Coronavirus pandemic lingers and experts are left in a dilemma in predicting a definite last date to the war against the virus, there can be no better opportunity than now to analyze the idea of UBI and evolve an appropriate mechanism.

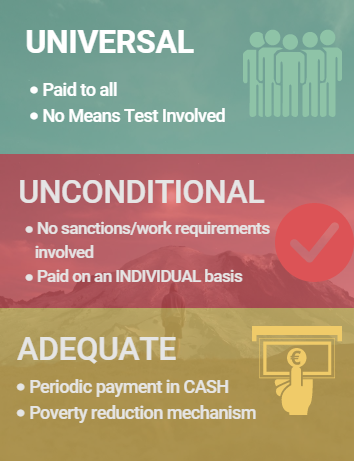

Figure 1: Summary of UBI

Need for UBI

With a 90% informal sector-led economy, India’s working poor are the worst-hit at this point of time. As per the data provided by the Chief Labour Commissioner, India has 26,17,218 internal migrant workers, of whom, 10% are in relief camps, 46% are in-situ laborers at workplaces and 43% in clustered migrant localities. Stringent lockdown measures, loss of jobs and social distancing has led migrant and informal sector workers through great agony and initiated the process of reverse migration of over 30 million workers since mid-March. The Asian Development Bank had estimated the total proportion of employed population below $1.90 PPP a day in India at 10.7% in 2019. Unemployment rate in the month of May 2020 figured at 23.48% reflecting the pandemic woes. The UN has already warned India that over 400 million in the informal economy are facing grave risk of falling into poverty and over 195 million full-time jobs will be non-existent globally. Moreover, the top ten percent of the country possess 77% of the total wealth of the nation pointing to widening gap between the rich and poor. This health and economic crisis can escalate into a social chaos. With loss of income and impoverishment, people will resort to borrowings. Without adequate means of income, they are likely to default on payments necessitating the need to borrow again. It thus remains uncertain as to how will people survive amidst joblessness, disease, lack of basic necessities and uncertainty of tomorrow and if everyone will benefit equally from the economic stimulus package announced by the Central Government.

Analyzing the Potential

A radical measure in the form of a universal basic income guarantee should be pondered upon without denigrating it as ‘free lunches’ or ‘doles’. Evidences on the effects of UBI in developing nations are few. Nevertheless, existing evaluations based on pilot interventions in the State of Madhya Pradesh and in countries like Namibia & Iran have not yielded negative results. People seemed to limit their expenditure on temptation goods. Positive impacts on income, savings, education, health, women empowerment etc., have also been observed. Cash transfers did not dissuade people from working as popularly believed. Instead, this basic income provision prompted them to avoid exploitative working conditions and bargain better. People were able to exercise agency in their utilization of the basic income too.

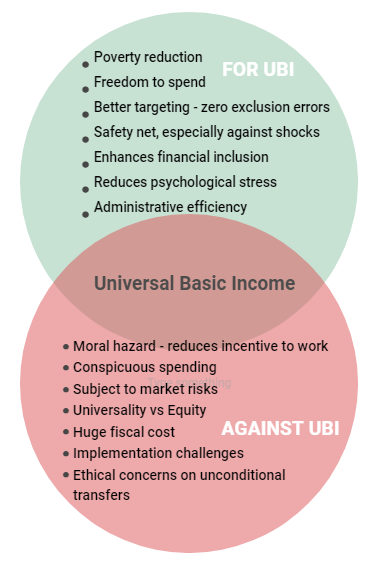

Figure 2: Arguments in favor of and against UBI

Such a universal system in a developing country would help in countering the problems associated with targeted welfare schemes (such as exclusion and inclusion errors in beneficiary identification and leakages) and reduce administrative costs. It presents scope for an enhanced redistributive system focusing on welfare, free of corruption and devoid of abuse of power. As a safety net, this will provide a cushion to fall back on in times of unanticipated events. It also presents an opportunity to minimize gender disparities to a great extent by direct transfers to the beneficiaries’ bank accounts. The UBI can also partially serve in recognizing the value of work performed by women in the households.

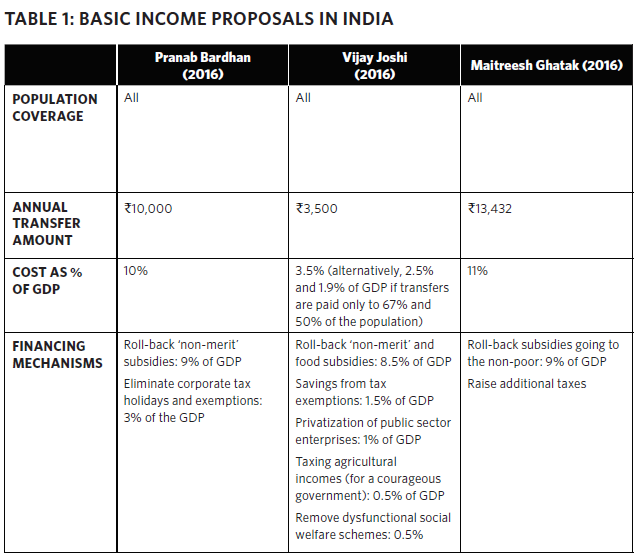

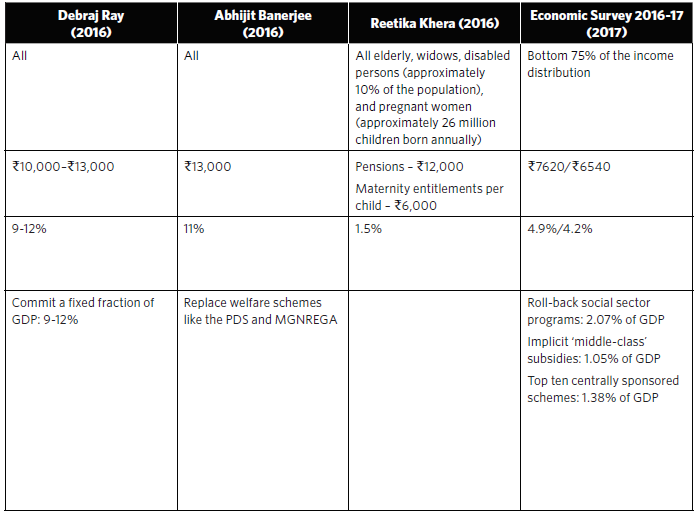

Opponents of the idea argue that huge fiscal costs in undertaking UBI is their primary cause of concern. This concern usually arises from a rough calculation of the size of monthly income for the population when in fact the accurate real cost is far less than it. A few basic income proposals ranging from Rs. 3000 to Rs. 13,000 as annual transfer amounts are presented in Table 1.

Image Source: India’s Universal Basic Income: Bedeviled by the Details, Saksham Khosla, Carnegie Endowment for International Peace.

Image Source: India’s Universal Basic Income: Bedeviled by the Details, Saksham Khosla, Carnegie Endowment for International Peace.

Possible Source and Structure of UBI

Sources of funding suggested by experts range from progressive taxation (wealth and inheritance taxes), elimination of corporate tax holidays and customs duty exemptions, revamp of budgetary expenditure plans and allocations, elimination of inefficient subsidies, foreign borrowings, public financing via issue of government bonds, utilizing foreign exchange reserves, eliminate inefficient social sector schemes etc. Feasibility of the scheme should not be a problem as long as it is pegged to a level of income ‘adequate’ to enjoy a minimum decent living considering location (rural/urban) and market fluctuations. Also, this will be an excellent opportunity to minimize wasteful expenditures that ineligible beneficiaries receive under most targeted interventions. Indians are familiar with direct benefit transfers to their own bank accounts linked to Aadhaar and this can serve as a potential medium for the transfer. But, implementation challenges could arise in the access to digital banking infrastructure and the lack of up-to–date comprehensive population data. This could pose more difficulties than the costs involved in running the UBI scheme.

UBI vs Social Sector Schemes

The latest Economic Survey reveals that only 7.7% of India’s GDP is spent on the social sector, with negligible increases from previous years. It would not be desirable to withdraw major social sector schemes and introduce the UBI in their place as the sole solution. These social schemes cover diverse arenas and their utility lies in building capabilities beyond mere monetary support. Despite their significance, these schemes have not fared to the desired levels either. The nation still finds 194.4 million in an undernourished state and a large majority may not even be in possession of ration cards to access food grains. Nevertheless, calls to eliminate food subsidies are unjust as the Right to Food is invaluable to the survival of the poor. Evaluation of pilot projects in three Union Territories introducing direct transfers in lieu of subsidized food observed that it costs more to the beneficiaries to access ATMs than to collect rations from a fair price shop. The agency that minimum income provides will help diversify existing dietary habits or may be diverted to other non-food consumption or even savings. A good approach to this conundrum would be to consider UBI along with other social sector schemes. Periodical evaluations on the efficiency and effectiveness of this mix can pave way for further reforms in terms of continuing or dismantling existing schemes.

Policy Suggestions

- UBI can serve as a complementary tool to other welfare schemes offering basic necessities such as Public Distribution Schemes. A sufficient basic income that will promote sustenance, work and savings will be appropriate. At least a quasi-universal UBI should be worked out to reduce the burden on the poor in the rural and urban areas during this period of pandemic.

- A fair system of progressive taxation, preventing tax evasions and eliminating inefficient subsidies can provide for the costs. A fixed percentage from the funds kept for meeting contingency needs such as PM CARES could be utilized for meeting the immediate needs until sufficient resources are identified.

- Appropriate interventions to include all those who may be excluded from erstwhile schemes (PDS, MGNREGA etc.) should be identified and enlisted, taking help from local government and civil society organizations.

- Required infrastructure would include active bank accounts, digital access, and proper payment transfer mechanisms. The digital divide present in the country has to be accounted for and rural masses in remote areas can be reached via local government officials at public places (adhering to social distancing norms).

- Convince the tax-paying citizens and corporates to support the implementation of this programme through awareness and sensitization so that they emerge socially responsible and considerate towards the well-being and welfare of their fellow citizens.

- Institution of proper feedback, grievance redressal and accountability mechanisms.

From an ethical perspective, the ability to lead a dignified life is an end in itself. Ensuring the well-being of all citizens is the prime responsibility of the State. This duty can be undertaken via UBI in a socially just manner. UBI as a ‘right’ strives to offer equal opportunities to all. By virtue of being citizens of a country, every individual ought to have a basic right to minimum income. The understanding that UBI will serve the constitutional entitlement of ‘Right to Life’ is a prerequisite for popular participation and successful implementation. ‘Wiping every tear from every eye’ is the responsibility of the government and the need of the hour is to preserve the lives and livelihoods of all citizens of the country.

By Liz Maria Kuriakose, Research Associate, Human Rights and Social Justice Policies